Can You Deduct Home Office Expenses In 2024 Year – The standard deduction reduces the amount of your taxable income—the IRS has increased it in 2023 and 2024, which could result in a lower tax bill for many Americans. . The flat-rate home-office expense deduction is no longer available for 2023. But eligible employees who work from home can still claim a deduction. .

Can You Deduct Home Office Expenses In 2024 Year

Source : www.cnbc.com25 Small Business Tax Deductions To Know in 2024

Source : www.freshbooks.com2024 Tax Tips: Home office deduction

Source : www.cnbc.comHome Office Tax Deduction in 2024 New Updates | TaxAct

Source : blog.taxact.comHome Office Deduction for Small Business Owners | Castro & Co. [2024]

Source : www.castroandco.comDo I Qualify for the Home Office Deduction? Intuit TurboTax Blog

Source : blog.turbotax.intuit.comMaximizing Home Office Deduction (2024) | myCPE

Source : my-cpe.comThe Home Office Deduction TurboTax Tax Tips & Videos

Source : turbotax.intuit.comAime & Co. Tax Services | Linden NJ

Source : m.facebook.comSmall Business Tax Deductions Checklist 2024 Blog Akaunting

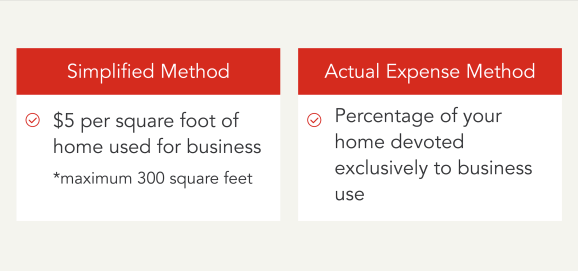

Source : akaunting.comCan You Deduct Home Office Expenses In 2024 Year 2024 Tax Tips: Home office deduction: Here are some of the most popular tax breaks for the 2024 certain home office deductions for associated rent, utilities, real estate taxes, repairs, maintenance and other related expenses. . That may make you wonder whether you can claim a home office tax deduction on your federal income tax return. After all, you likely have some unreimbursed expenses of the year, you can .

]]>